One thing we see businesses doing time and again is attempting to manage their business identity verification program in-house. On the surface, this seems like it’d be an easy aspect of your business to manage. However, once you realize everything that’s involved with identity verification, it’s easy to become overwhelmed by the process.

This seemingly straightforward task is often riddled with complexities, which we will explore in this three-part blog series.

Why companies attempt business identity verification in-house

Business identity ends up becoming one of the more common conversations where third party sellers or business buyers are involved - build versus buy. The issue is that most companies, big and small, underestimate the complexity of the task.

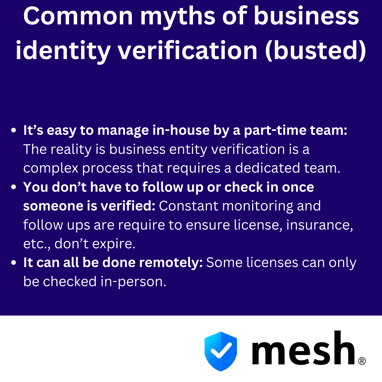

It’s not just a matter of plugging in a few APIs and collecting end-user data. There’s more nuance to the process that organizations don’t realize exists. For instance, verification can involve documentary evidence, business license verification, insurance verification, research into possible liens, judgements, bankruptcies all requiring access to hundreds of data sources and in some cases requiring in-person interactions with local or county offices.

Once you get through the initial verification and renewals, “tracking” and follow-ups need to be considered, as well. For example, an in-house verification program needs to be able to manage the complete business identity verification lifecycle including situations like, when a business license is about to expire. In that scenario, the in house system needs a reminder and follow up system. And, if the license or the insurance expires the in-house system needs a workflow to manage the reinstatement.

What we’ve seen is that smaller businesses don't have the resources and the larger organizations have the money, but they lack the expertise to fully own and manage the risk and compliance requirements of business identity verification. The common hidden challenges of in-house business identity lifecycle management.

As we developed Mesh, we found three problems that tended to show up again and again. These issues arise because of the hidden complexity of the process and tend to show up after an organization has gotten far enough along the in-house business identity verification process to start hitting walls because of their lack of understanding of the full process.

All of these hidden complexities are tied together. One challenge doesn’t necessarily cause the other, but they piggyback off each other in a way that turns a small problem into an increasingly large one. And, when you consider that the downsides to building (cost overruns, missed deadlines, etc.) have been known for a long time, it often makes more sense to use a trusted partner, rather than attempting to do it yourself.

Monitoring complexities

Far too often, companies think that they can get away with verifying a business or vendor in their platform and that’s it. There’s a temptation to think that you only need to check in on things once a year, but infrequent monitoring can lead to legal liabilities and significant damage to a business's reputation. This leads to very real-world consequences that can have long-lasting effects on any organization.

With business identity verification, you need to be constantly tracking their status to ensure that nothing has expired or become otherwise outdated. It’s one thing to forget about renewing your license for a few days. That happens to the best of us. But if a business or vendor has a seriously lapsed license and they’re being endorsed by your platform, you’re liable for any issues that arise.

Staffing quandaries

Business identity verification isn’t something that can be handled part-time by a staff member who’s got other responsibilities. Often, there is a very real need for dedicated staff to handle the process.

Relying on a limited team or a single individual can be risky and create a single point of failure for the entire process. Not only that, but the true cost of these operations goes beyond financial implications. You need to balance staffing needs with operational efficiency, a critical aspect often neglected. One person slowly going through verification on the side isn’t going to the time they need to monitor license status, for example.

Standards operations and training

Some aspects of business identity verification that are easy to standardize, like plugging in an API and verifying online. Others aren’t nearly so straightforward.

Let’s take end-user data capture, for example. In order to onboard someone you have to capture information in a seamless and friction-less way. Different kinds of verification may require different kinds of user experience. If your company needs to capture a contractor's license and insurance information, you may also need to capture a third party supplier to the company's business risk status. Each of these types of actions requires different fields and an end-user data capture experience that is different from event to event.

Beyond that, business identity verification is a process and every single process in your organization should have a documented process that your team follows and training to ensure that the process is followed.

The development and maintenance of robust standard operating procedures are essential for the smooth running of your verification processes from both the buyer and seller side of your business. You should be able to quickly onboard B2B customers, while conducting moderate due diligence. At the same time, a deeper verification should be done on the seller side to identify businesses with past offenses or marketplace bans to ensure the integrity and compliance of any business you feature. These specific approaches lead to a verification process that enables the business to efficiently and effectively meet the needs of different customer types.

Along with creating a process and developing the training to support the process, the challenge here is that if you don’t have a business identity verification expert within your business, you risk creating a process that is incomplete or, worse, lacks an understanding of the nuances involved in the process.

Bringing it all together

Rather than relying on a series of disconnected tools and processes, you deserve a single pane of glass to verify everything in order to help protect your customers. You need to find a way to easily go beyond simple business license verification to include insurance verification, and business risk (whether or not there are judgments or liens against a business).

More than that, rather than dealing with the hidden complexities of staffing issues, standard operating procedures, and training, it’s better to remove those tasks from your business. We know you’d rather focus on serving your customers directly, rather than digging through licensing archives or navigating the IRS to investigate liens.

When you remove business identity verification from your business, you’re able to better focus on providing your customers exactly what they need, while protecting them from fraud.

In our next post, we’ll explore how automation can further improve your business identity verification process.